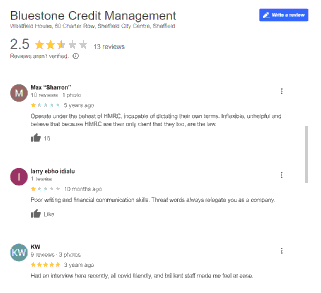

BCM and Bluestone Credit Management are trading styles of Bluestone Consumer Finance Limited.

They a specialist debt collection firm that collect outstanding debts on behalf of UK’s largest companies in Utilities, Retail and Government. They also collect debts on behalf of HMRC

You may have had previous letters and calls about these debts from the original creditor.

They are one of the largest debt collection agencies in the UK.

Bluestone Credit Management is authorised by the Financial Conduct Authority (FCA) and is a member of the Credit Services Association.

Their offices are in based in Westfield House, 60 Charter Row, Sheffield S1 3FZ.

Chances are they are calling or writing to you because they are trying to collect a debt on behalf of the original lender or service provider, and believe you owe money.

The original debt won’t be to Bluestone, which is why you might not recognise the name.

If you have been contacted by them, you have to make a decision on how to deal with them.

Yes, Bluestone Credit Management are legitimate organisation.

They are authorised by the Financial Conduct Authority.

They are also CSA members and must follow their Code of Practice and provide a declaration of compliance with statutory legislation.

Just because they keep calling or are writing you letters stating that you owe them money, does not mean you actually do. YOU MUST CHECK!

Bluestone will be contacting you because they believe that you owe money to one of their clients. The business or organisation that you originally owed the money to will have passed the debt and your details to Bluestone Credit Management once their own attempts to collect payment from you had failed.

Bluestone Credit Management collect debts on behalf of a number of organisations such as banks, building societies and other financial institutions, as well as a range of other businesses such as utility companies, mobile phone companies and private parking companies.

Their clients include some of the largest businesses in the UK, including: British Gas, United Utilities, HMRC and many more.

A lot of debt collectors actually buy some of the debts they chase from the original credit that you owe money to. They buy these debts in bulk at a lower price than the original debt in the hope that they can make a profit when they collect the full amount that is owed.

If you're one of the many people being sent constant letters, text messages and not answering your phone without looking at "whocallssme.com" in order to avoid the many (and we mean MANY) phone calls by Bluestone. Or if you have received a letter about a debt you don't recognise or think you've paid off, or if you are struggling to repay Bluestone Debt Collectors, fill in our simple form and we’ll call you back to see if we can help.

You can also read our "11 steps to deal with debt collectors". This guide explains exactly what they can do and how to dispute a debt and how to handle their calls and letters.

The actions that Bluestone Credit Management will take will depend on a number of factors, including the amount you owe and whether they think there is a realistic chance that you will be able to pay the debt.

DCAs like Bluestone have no special legal powers.

They cannot make changes to your original contract.

They may contact you by:

- Post

- Phone

- Text message

- Email

Letters or phone calls from collection agencies can be worrying.

They may use court action or send someone to visit your home.

They can take court action if you do not pay.

They cannot lie or mislead you about their legal powers. They should not make an excessive amount of phone calls, although this one is open to abuse.

Court action is less likely if you tell them you are getting debt advice and want to pay what you can afford.

They may have been passed your number by the original creditor. Or they may pay a data company to look up and match your details and contact number from other sources you may have registered with. EG. Online orders, websites or mail order company databases.

Usually the first thing Bluestone Credit Management will do is send a letter stating that they are collecting money that you owe. If you do not respond, they will try to contact you by phone and might even send a ‘doorstop collector’ or ‘field agent’ to your home. If they do not get a response from you they often decide to apply to the court for a County Court Judgement (CCJ).

You can stop them writing, calling, visiting and taking you to court by either paying the debt in full or if you cannot afford to do that, agreeing a payment plan with them.

You may also be able to stop them if you can prove that you do not owe the money that Bluestone are chasing you for.

Bluestone Credit Management can send a ‘doorstop collector’ or ‘field agent’ to your home, but they cannot send bailiffs without first obtaining a County Court Judgement against you.

Bluestone Credit Management cannot take your home without going to court first. Even then it is extremely unlikely that the Court would order the sale fo your home for a debt that Bluestone Credit Management are chasing your for.

An Attachment of Earnings Order is obtained from a court. If Bluestone Credit Management can persuade a court to agree to an Attachment of Earnings Order this would mean that any payments towards your debt are taken straight from your wages before you are paid.

Of course you can, but this it is not advisable to ignore any debt collection agency. They have the option of taking you to court and if they take you to court and are successful you will have a CCJ registered against you, and can face enforcement action like an attachment of earnings or bailiff visits.

Most debt collectors, including Bluestone, will be keen to sort the matter out by arranging an affordable payment plan.

Yes, you can stop Bluestone debt collectors from contacting you by sending them a Cease and Desist letter. However this only applies if the debt does ot belong to you. You should send this letter via Recorded Delivery so you can prove that they have received it.

If you do owe the debt BCM can still legally contact you to chase payment.

There is also nothing to stop Bluestone Credit Management passing your debt on to another debt collector and then the new debt collector that has bought the debt chasing you. So the whole cycle starts again.

There are a number of reasons that you might not owe the money that BCM are asking for.

It is possible that there has been an administrative error and the debt does not even belong to you, or the amount being claimed is incorrect.

Alternatively, you may have already paid the debt but Bluestone are not aware that you have already settled this debt.

This actually happens a lot. Often service providers have not closed the file down properly or there has been a data entry error. This is why it is very important that you request proof of the debt before you make a payment. You can use our free “prove the debt letter” template to help you contact Bluestone Credit Management to request proof that the debt exists and you are actually liable to pay it.

It is also quite common for a debt collection agency to try and collect a debt that is statute-barred.

The Limitation Act 1980 sets out the rules on how long a creditor (who you owe money to) has to take certain action against you to recover a debt. The time limits do not apply to all types of recovery action. Also, the time limits are different depending on the type of debt that you have.

Limitation periods for debts are important because if the creditor has run out of time, you may not have to pay the debt back.

If a debt is barred under statute, it means that by law (the Limitation Act), the lender has run out of time to use certain types of action to try and make you pay the debt.

This means that if 6 years have passed – 5 years in Scotland – since you last made a payment or made communication about the debt.

Statute-barred does not mean the debt no longer exists. The creditor or a debt collection agency can still try to recover money from you. They just can not take legal action against you to recover the money.

Once you have told Bluestone Credit Management that you are disputing the debt because you think it is statute-barred, it is up to them to prove otherwise. Don’t be afraid to ask for evidence if they tell you a payment has been made, or a letter has been received.

If Bluestone Credit Management can show evidence that you owe the debt, contact us for advice.

If you cannot afford to pay your debt in full and you need to set up an affordable repayment plan, you will need to first work out a budget that determines how much you can afford to pay each month.

To do this, you will need to work out how much money you have coming in each month, and how much you have to spend each month.

The money coming in each month will include your wages and any benefits that you are receiving. Your outgoings will include your mortgage or rent, Council tax, gas, electricity and water bills. The cost of your supermarket shopping, travel expenses and all of the other essential expenses that you incur.

It is important that your budget is accurate because there is no point in agreeing to and setting up a repayment plan if you later realise that you can’t afford it!

If you need help working out your budget, please call our team on 0800 368 8130

If you cannot afford to pay anything to BCM, you should contact us to see what help is available.

Yes, sometimes debt collectors will accept a partial payment as a full and final settlement of the debt.

Full and final settlement means that you ask your creditors to let you pay a one off, lump-sum payment instead of the full balance you owe on the debt. In return for having a lump-sum payment, the creditor agrees to write off the rest of the debt.

You may be able to do this because you have come into some money or have some savings you can use. Sometimes a friend or relative offers to put forward a lump sum to help you pay off the creditors. If your circumstances are unlikely to change for the better in the future, you can explain why this is. Explaining to the debt collection agency that the money will not be available forever and the friend or relative will not make the payments unless the offer is accepted increases the chances of the creditor accepting your reduced offer of payment.

If Bluestone Credit Management are contacting you about a debt that you are able to repay, either in full or via an affordable repayment plan, your best bet is probably to deal with the debt that way.

If you can’t afford to pay Bluestone, or this is just one of many debts that you are struggling with, you may want to consider a debt solution.

There are several debt solutions available in the UK. There are solutions to help you pay back what you owe at a rate you can afford or even write off your debts if you can’t afford a monthly repayment.

If you are struggling with your debts it is important that you speak to a debt adviser to get help choosing the best way to deal with your debt.

Debt Management Plan (DMP)

Debt Management involves negotiating agreements with your Creditors to make reduced payments to them each month, usually with the help of a Debt Management company or a debt charity.

Before setting up your plan, your DMP advisor will help you put together a budget. This will show your creditors how much you can afford to pay to your debts after all your priority payments and living expenses have been covered.

Once your debt management plan is set up, you’ll make a monthly payment to your DMP provider and they’ll pass on the correct payments to your creditors.

But keep in mind that your creditors don’t necessarily have to agree to your terms and they can change their mind or sell your debts to other companies.

Individual Voluntary Arrangement (IVA)

Individual Voluntary Arrangements, or IVAs, were introduced to help people who can’t afford to repay debts above £6,000.

An IVA could write up to a portion of your unaffordable debt, reducing your debt by making affordable payments over 60 months.

At the end of the IVA, any leftover debts are written off.

Debt Relief Order (DRO)

If you have debts but no real assets and little income, you may be able to qualify for a DRO.

A Debt Relief Order, or DRO, is a possible solution for non-homeowners where debts can be written off, similar to Bankruptcy.

It is aimed at people who cannot make repayments to their creditors, with few assets and up to £30,000 of debt.

Debt Consolidation

Debt Consolidation can make things much simpler for you. It allows you to put your all your debts in one place and deal with multiple creditors at once.

Bankruptcy

Bankruptcy is usually considered a last resort but can be an effective solution for those in severe financial difficulty as all debts included are written off.

Breathing Space

Breathing space, also known as the Debt Respite Scheme, was introduced by the UK government on May 04th 2021. It is designed to give people time and protection from creditors so that they can get debt help and support.

By getting breathing space you get a 60-day hold on enforcement action and additional interest and charges by creditors (the people and companies you owe money to).

The breathing space scheme is free, however, you must pass the eligibility checks, and it must be set up by a professional debt advice provider. You must also look at setting up a suitable solution to your debt problems during this time.

There are two kinds of breathing space in England and Wales.

Standard breathing space is where creditors will have to stop collection and enforcement of your debts. Creditors will also have to freeze interest and charges on any eligible debts.

Mental health crisis breathing space can provide extra protection for people who are receiving mental health crisis treatment.

Breathing space can be looked at being put in place if you are already behind with your payments. If you are up to date with your household bills and credit repayments and can afford them, breathing space is unlikely to be an option for you.

Scottish Solutions

If you’re in Scotland, your options will vary from the rest of the UK. We provide information on solutions such as Trust Deeds, Sequestration, and other solutions that may be more suitable.

Many people dread having to speak to a debt collector. It’s okay to feel embarrassed if you are suffering money problems. However, debt collectors like Bluestone Credit Management have been dealing with people in your situation for years and will deal with you sensitively. At the end of the day, it is in their interest to work with you to come to an arrangement so that the debt is paid.

If you really don’t want to speak to BCM on the phone, call us free on 0800 368 8130 to see how we can help.

Bluestone Credit Management and their parent company Bluestone Consumer Finance Limited are regulated by the Financial Conduct Authority (FCA). This means that they need to stick to the FCA guidelines.

If you think that Bluestone (BCM) have broken these rules when dealing with you, you can make a complaint.

You should first make a complaint directly to BCM. This will give them the opportunity to deal with the matter with their own policies.

If you feel that your complaint was not dealt with appropriately, you can raise your complaint with the Financial Ombudsman Service (FOS). They will deal with your complaint and, if they rule in your favour, they may fine Bluestone Credit Management and you may be owed compensation.

Most debt collectors are very persistent.

Most of their activities are driven by automated computer systems that call you and send out letters at certain dates. Therefore it is not much effort or cost for them to keep chasing you.

Numbers they call from:

0114 212 8644